The Rise of Freelance Actuaries: Is It the New Norm?

- Risk modeling

- Product pricing

- Regulatory compliance

- Valuations

- Financial forecasting

- Data analysis and visualization

🚀 Why Is Freelancing Gaining Popularity Among Actuaries?

Many actuaries are seeking more autonomy over their time. Freelancing allows them to:

- Choose their projects

- Set their working hours

- Work from anywhere

This appeals especially to young professionals, parents, and those pursuing work-life balance without compromising their careers.

Experienced actuaries, especially those with niche expertise (e.g., IFRS 17, predictive analytics), can charge premium consulting rates. Instead of a fixed salary, they’re compensated for the value and impact they deliver.

Freelancers aren’t bound by geography. With platforms like LinkedIn, Upwork, and even actuarial forums, clients from the UK, US, Canada, and Australia now seek remote actuarial support from professionals based in India, South Africa, and beyond.

Unlike full-time roles that often involve repetitive tasks, freelance work provides exposure to:

- Different industries (insurance, health-tech, climate risk)

- Varied clients (from startups to global insurers)

- Cutting-edge tools and technologies

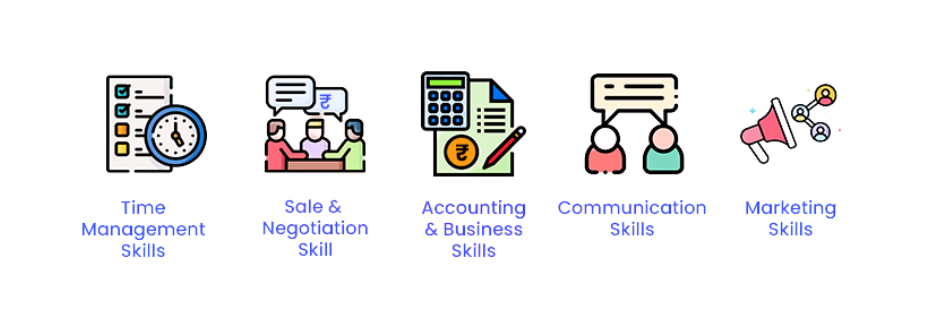

Freelancing isn’t just about knowing actuarial formulas—it’s about being a complete professional. Successful freelance actuaries need:

- ✅ Actuarial Expertise: A solid grasp of core actuarial principles and exam completion (IFoA, IAI, or SOA).

- 🧠 Technical Proficiency: Skills in R, Python, SQL, Excel, VBA, Power BI, or actuarial modeling software.

- 💬 Communication Skills: The ability to explain technical findings clearly to non-technical clients.

- 🌐 Self-Marketing: A polished LinkedIn profile, personal website, or presence on freelance platforms.

- 📅 Time Management: Balancing multiple projects, deadlines, and client expectations.

Freelancing offers freedom, but it’s not without hurdles:

- Income Instability: Work may not be consistent every month.

- No Employee Benefits: No health insurance, paid leave, or employer-sponsored training.

- Client Acquisition: Building a client base requires effort, networking, and sometimes, cold outreach.

- Isolation: Unlike office jobs, freelancers often work alone—something not all personalities thrive in.

Several macro trends are encouraging this movement:

- Digital Transformation: Insurers and fintechs are hiring temporary consultants for data migration, automation, and model upgrades.

- Remote Culture: Post-COVID, companies are more open to hiring virtual teams.

- Regulatory Surges: Complex and evolving regulations (like IFRS 17, Solvency II) require on-demand, expert help.

Aspiring freelance actuaries can explore:

- Upwork, Freelancer.com – Popular freelance job boards

- LinkedIn & Naukri – For short-term contracts or remote roles

- Actuarial forums – Like Actuarial Outpost, Reddit (r/actuary)

- Direct outreach – Cold emailing actuarial firms or networking with HR professionals

🧭 Is This the New Norm?

While freelancing won’t replace traditional actuarial jobs, it’s no longer just a side option. The industry is evolving. Startups need agile consultants. Corporates want flexible experts. Actuaries themselves want control over how they work.

In the next decade, we’re likely to see a hybrid actuarial workforce—one where freelance and full-time professionals collaborate across time zones, companies, and contracts.

✅ Conclusion

The actuarial world is changing—and freelancing is at the forefront of this transformation. Whether you’re a seasoned actuary looking for flexibility or a young aspirant eager to build a dynamic career, freelancing could be your gateway to freedom, variety, and growth.

But remember: like any career path, it requires strategy, skill, and stamina.

So, is freelancing the new norm?

Not yet for everyone—but for many, it’s already the future.